Get Your Credit Scores & Credit Reports from All 3 Bureaus, Instantly!**

Why ScoreSense®?

See what lenders may see

Know when things change

Understand your scores

Protect your money

FAQ

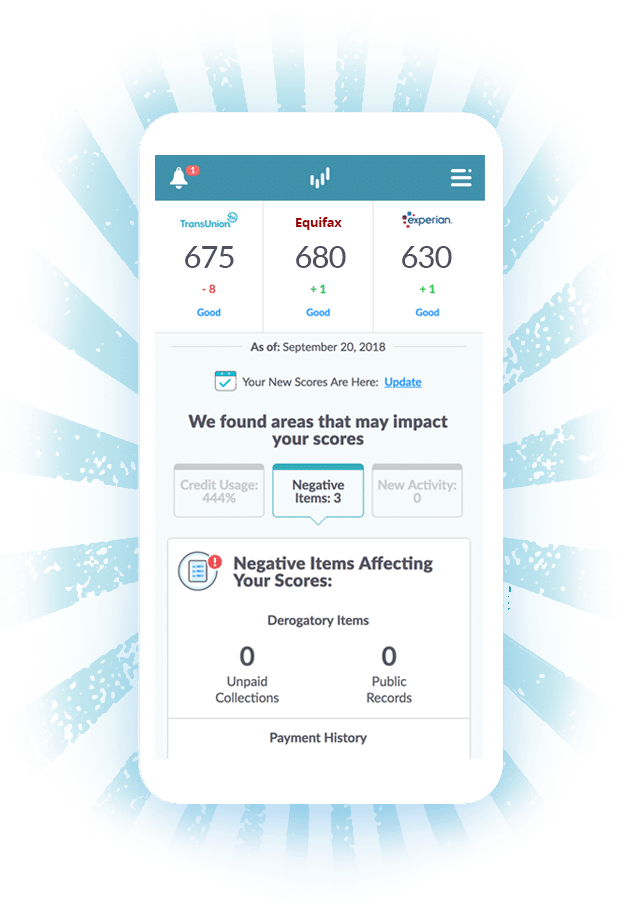

Not at all. In fact, you should regularly check your credit reports from TransUnion, Equifax and Experian to be sure there are no score-lowering errors or possible fraud. We make it easy to see monthly updates to your credit scores and review your reports from all three credit bureaus.

Lenders don’t all use the same credit bureau to check your credit – and your credit scores may not all be the same. We provide your scores from TransUnion, Equifax and Experian so you know where you stand no matter which bureau lenders use!

File a dispute! Errors or fraud can lower your credit scores and cost you money. Our Dispute Center provides a step-by-step guide to help you navigate the process of filing a dispute with all three credit bureaus.

We monitor your credit report, daily, and notify you with a credit alert when a change or suspicious activity is detected that could pose a threat to your credit scores or be a red flag for possible identity theft.